Introduction

Payment Link is available for Digital Payments, Checkout v2, Payment Menu v1 and the payment methods listed below, using the redirect platform and Swedbank Pay hosted payment page.

When the payer starts the purchase process in your merchant or webshop site, you

need to make a POST request towards Swedbank Pay with your Purchase

information. You receive a Payment Link (same as redirect URL) in response. The

link will be active for 28 days.

You have to distribute the Payment Link to the payer through your order system, using channels like e-mail or SMS.

When sending information in e-mail/SMS, it is strongly recommended that you add information about your terms and conditions, including purchase information and price. See recommendations in the next section.

When the payer clicks on the Payment Link, the Swedbank Pay payment page will open, letting them enter the payment details (varies depending on payment method) in a secure Swedbank Pay hosted environment.

When paying with card, and if required, Swedbank Pay will handle 3-D Secure authentication.

After completion, Swedbank Pay will redirect the browser back to your merchant/webshop site.

If callbackURL is set the merchant system

will receive a callback from Swedbank Pay, enabling you to make a GET request

towards Swedbank Pay with the id of the payment received in the first step,

which will return the purchase result.

E-mail And SMS Recommendations

When you as a merchant send an e-mail or SMS to the payer about the Payment Link, it is recommended to include contextual information which helps them understand what will happen when they click the Payment Link. We recommend that you include the following:

- The name of the merchant/shop initiating the payment

- An understandable product description, describing the service they are paying for.

- Some order-id (or similar) that exists in the merchant’s order system.

- The price and currency.

- Details about shipping method and expected delivery (if physical goods will be sent to the payer).

- A link to a page with the merchant’s terms and conditions (such as return policy) and information about how the payer can contact the merchant.

- Details informing that the payer accepts the Terms & Conditions when clicking on the Payment Link.

Receipt Recommendations

We recommend that you send an e-mail or SMS confirmation to the payer with a receipt when the payment is done.

API Requests

The API requests depend on the payment method you are using when

implementing the Payment Link scenario, see purchase flow.

One-phase payment methods will not implement capture, cancellation or

reversal.

The options you can choose from when creating a payment with key operation

set to Purchase are listed below.

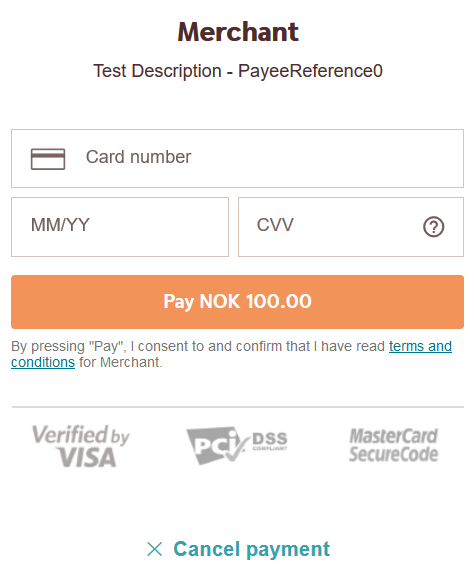

How It Looks

When clicking the payment link, the payer will be directed to a payment page similar to the examples below, where payment information can be entered.

Options

All valid options when posting a payment with operation Purchase, are

described in each payment method’s respective API reference. Please see the

general sequence diagrams for more information about one-phase (e.g.

Swish and Trustly) and two-phase (e.g. Card,

MobilePay Online and Vipps) payments.

Authorization

When using two-phase payment methods you reserve the amount with an

authorization, and you will have to specify that the intent of the purchase

is Authorize. The amount will be reserved but not charged. You have to make a

Capture or Cancel request later (i.e. when you are ready to ship the

purchased products).

Capture

Capture can only be performed on a payment with a successfully authorized transaction. It is possible to do a part-capture where you only capture a smaller amount than the authorized amount. You can do more captures on the same payment up to the total authorization amount later.

If you want the credit card to be charged right away, you will have to specify

that the intent of the purchase is AutoCapture. The card will be charged and

you don’t need to do any more financial operations to this purchase.

Cancel

Cancel can only be done on an authorized transaction. If you cancel after doing a part-capture you will cancel the difference between the captured amount and the authorized amount.

Reversal

Reversal can only be done on a payment where there are some captured amount not yet reversed.

General

When implementing the Payment Link scenario, it is optional to set a

callbackURL in the POST request. If

callbackURL is set Swedbank Pay will send a request to this URL when the

payer has completed the payment. See the Callback API description

here.

Purchase Flow

The sequence diagrams display the high level process of the purchase, from generating a Payment Link to receiving a Callback.

This in a generalized flow as well as a specific 3-D Secure enabled credit card scenario.

Please note that the the callback may come either before, after or in the same moment as the payer is redirected to the status page at the merchant site when the purchase is fulfilled. Don’t rely on the callback being timed at any specific moment.

When dealing with card payments, 3-D Secure authentication of the cardholder is an essential topic. There are three alternative outcomes of a card payment:

- 3-D Secure enabled - by default, 3-D Secure should be enabled, and Swedbank Pay will check if the card is enrolled with 3-D Secure. This depends on the issuer of the card. If the card is not enrolled with 3-D Secure, no authentication of the cardholder is done.

- Card supports 3-D Secure - if the card is enrolled with 3-D Secure, Swedbank Pay will redirect the cardholder to the authentication mechanism that is decided by the issuing bank. Normally this will be done using BankID or Mobile BankID.

sequenceDiagram

activate Payer

Payer->>-MerchantOrderSystem: payer starts purchase

activate MerchantOrderSystem

MerchantOrderSystem->>-Merchant: start purchase process

activate Merchant

Merchant->>-SwedbankPay: POST [payment] (operation=PURCHASE)

activate SwedbankPay

note left of Merchant: First API request

SwedbankPay-->>-Merchant: payment resource with payment URL

activate Merchant

Merchant-->>-MerchantOrderSystem: Payment URL sent to order system

activate MerchantOrderSystem

MerchantOrderSystem-->>-Payer: Distribute Payment URL through e-mail/SMS

activate Payer

note left of Payer: Payment Link in e-mail/SMS

Payer->>-SwedbankPay: Open link and enter payment information

activate SwedbankPay

opt Card supports 3-D Secure

SwedbankPay-->>-Payer: redirect to IssuingBank

activate Payer

Payer->>IssuingBank: 3-D Secure authentication process

Payer->>-SwedbankPay: access authentication page

activate SwedbankPay

end

SwedbankPay-->>-Payer: redirect to merchant site

activate Payer

note left of SwedbankPay: redirect back to merchant

Payer->>-Merchant: access merchant page

activate Merchant

Merchant->>-SwedbankPay: GET [payment]

activate SwedbankPay

note left of Merchant: Second API request

SwedbankPay-->>-Merchant: payment resource

activate Merchant

Merchant-->>-Payer: display purchase result

Options After Posting A Payment

- If the payment enable a two-phase flow (

Authorize), you will need to implement theCaptureandCancelrequests. - It is possible to “abort” the validity of the Payment Link. See the Abort description here.

- For reversals, you will need to implement the

Reversalrequest. - When implementing the Payment Link scenario, it is optional to set a

callbackURLin thePOSTrequest. IfcallbackURLis set Swedbank Pay will send a postback request to this URL when the payer has completed the payment. See the Callback API description here.