Display Payment UI

There are a couple of decisions to be made when presenting your payment UI. You have the choice between a payment menu with all payment methods you want to offer, or with a single available payment method using instrument mode.

Regardless of the number of payment methods available to the payer, you also

need to choose between Redirect and Seamless View.

With Redirect, the payer is sent to a Swedbank Pay page where we handle the

purchase process. The payer is redirected back to you when the purchase is

completed or if the payer aborts the purchase. The page will be styled by

Swedbank Pay.

With Seamless View, the payer stays at your site and you initiate the

Swedbank Pay purchase module in an iframe. The purchase component will be styled

by Swedbank Pay.

Read about how you integrate them in the corresponding sections.

Display Redirect

Among the operations in the POST paymentOrder response, you will find

redirect-checkout. This is the one you need to display the payment UI.

Response

1

2

3

4

5

6

7

8

9

10

11

{

"paymentOrder": {}

"operations": [

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/checkout/6445a0d8d9a7f80a37f4e46fc600a0534a832e4b6ec0dbb6768dd362d9401a8b?_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "redirect-checkout",

"contentType": "text/html"

},

]

}

How Redirect Looks

We strongly advice against displaying the redirect page inside of an iFrame. If you need to be able to show the checkout page on your site, rather than redirecting to our page, we recommend you implement the Seamless View solution instead.

With the link, you only need to redirect the payer to the site to give them the option to select their preferred payment method to pay with.

Once the payer has completed the purchase, you can perform a GET towards the

paymentOrders resource to see the purchase state.

Redirect Sequence Diagram

Note that in this diagram, the Payer refers to the merchant front-end (website) while Merchant refers to the merchant back-end.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

participant 3rdParty

rect rgba(238, 112, 35, 0.05)

activate Payer

Payer ->>+ Merchant: Initiate Purchase

Merchant ->>+ SwedbankPay: POST /psp/paymentorders (completeUrl, payer information)

SwedbankPay -->>- Merchant: rel:redirect-checkout

Merchant -->>- Payer: Redirect payer to SwedbankPay purchase page.

Payer ->> Payer: Initiate Purchase step

Payer ->>+ SwedbankPay: Do purchase logic

activate SwedbankPay

opt Payer perform purchase out of iFrame

SwedbankPay ->>- Payer: Redirect to 3rd party required

Payer ->>+ 3rdParty: Redirect to 3rdPartyUrl URL

3rdParty -->>- Payer: Redirect back to SwedbankPay

Payer ->> Payer: Initiate Payment Menu

Payer ->>+ SwedbankPay: Show Purchase UI page in iframe

end

SwedbankPay -->>- Payer: Purchase status

alt If Purchase is completed

Payer ->> Payer: Redirect back to CompleteUrl

Payer ->>+ Merchant: Check Purchase status

Merchant ->>+ SwedbankPay: GET <paymentorder.id>

SwedbankPay ->>- Merchant: Status: Paid

end

Merchant -->>- Payer: Show Purchase complete

deactivate Payer

opt PaymentOrder Callback (if callbackUrls is set) ①

SwedbankPay ->> Merchant: POST Purchase Callback

end

end

rect rgba(81,43,43,0.1)

note right of Payer: Capture

Merchant ->>+ SwedbankPay: rel:capture

SwedbankPay -->>- Merchant: Capture status

note right of Merchant: Capture here only if the purchased<br/>goods don't require shipping.<br/>If shipping is required, perform capture<br/>after the goods have shipped.<br>Should only be used for <br>Payment Methods that support <br>Authorizations.

end

- ① Read more about callback handling in the technical reference.

Redirect - Next Steps

You are now ready to validate the payment’s status. Follow the link below to read more about how this is done.

Display Seamless View

Among the operations in the POST paymentOrder response, you will find the

view-checkout. This is the one you need to display the purchase module.

Response

1

2

3

4

5

6

7

8

9

10

11

{

"paymentOrder": {},

"operations": [

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/checkout/client/1c168a5f971f0cacd00124d1b9ee13e5ecf6e3e74e59cb510035973b38c2c3b3?culture=sv-SE&_tc_tid=123a825592f2002942e5f13eee012b11",

"rel": "view-checkout",

"contentType": "application/javascript"

},

]

}

Load the Seamless View

To display the UI, we need to take the href from the POST request and add

it to a script element on the webpage. Once the script has loaded in, we can

then use the payex.hostedView.checkout().open() function on the clientscript

to show the menu.

There are a few parameters we can set to further customize the menu itself, which are shown in the example below. This includes the place we want to open up the menu (container), the language we want the menu to display (culture), and any events we want to override.

JavaScript

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

// For this example, we'll be simply adding in the view-checkout link right in

// the script. In your own solution, it's recommended that your backend

// generates the payment and passes the operation to your frontend.

const url = new URL("https://ecom.externalintegration.payex.com/checkout/client/1c168a5f971f0cacd00124d1b9ee13e5ecf6e3e74e59cb510035973b38c2c3b3?culture=sv-SE&_tc_tid=123a825592f2002942e5f13eee012b11");

const script = document.createElement("script");

script.src = url.href;

script.type = "text/javascript";

script.id = "payex-checkout-script";

script.onload = function() {

payex.hostedView.checkout({

// The container is the ID of the HTML element you want to place

// our solution inside of.

container: {

checkout: "payex-checkout"

},

culture: "sv-SE",

// This is where you can add your own seamless events.

// See the section "Events" down below for more information.

onError: Function = (data) => console.error("onError", data),

onEventNotification: Function = (data) => console.log("onEventNotification", data)

}).open();

}

document.body.insertAdjacentElement("afterbegin", script);

HTML

1

2

3

4

5

6

7

8

9

10

11

<!DOCTYPE html>

<html>

<head>

<title>Swedbank Pay Checkout is Awesome!</title>

</head>

<body>

<div id="payex-checkout"></div>

<!-- Here you can specify your own javascript file -->

<script src="<Your-JavaScript-File-Here>"></script>

</body>

</html>

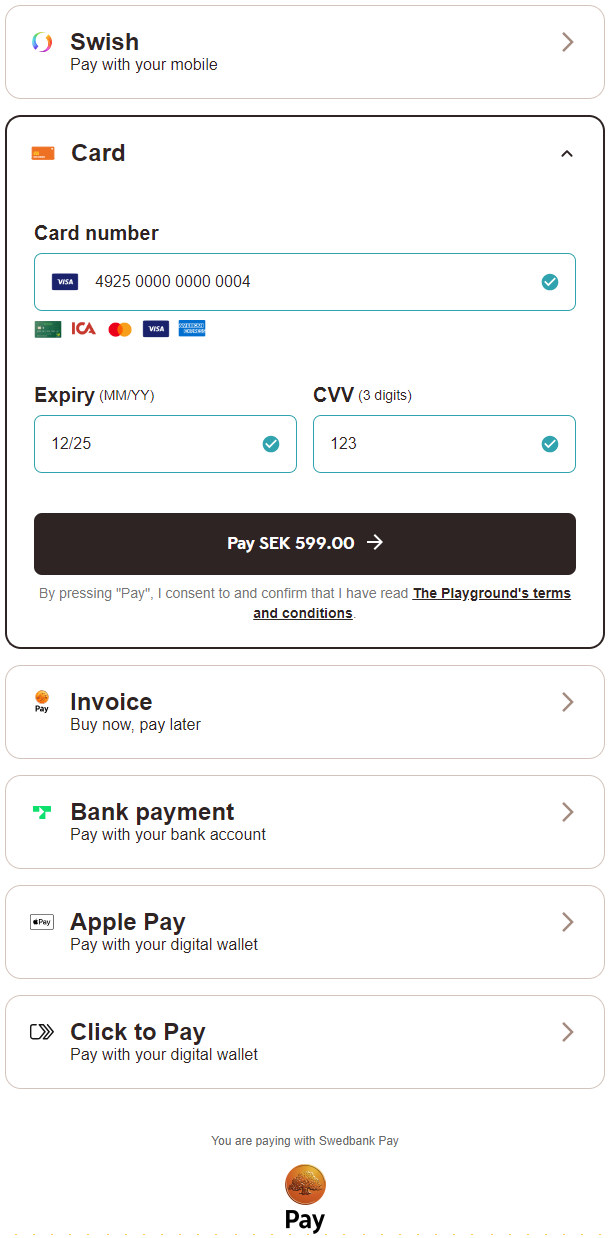

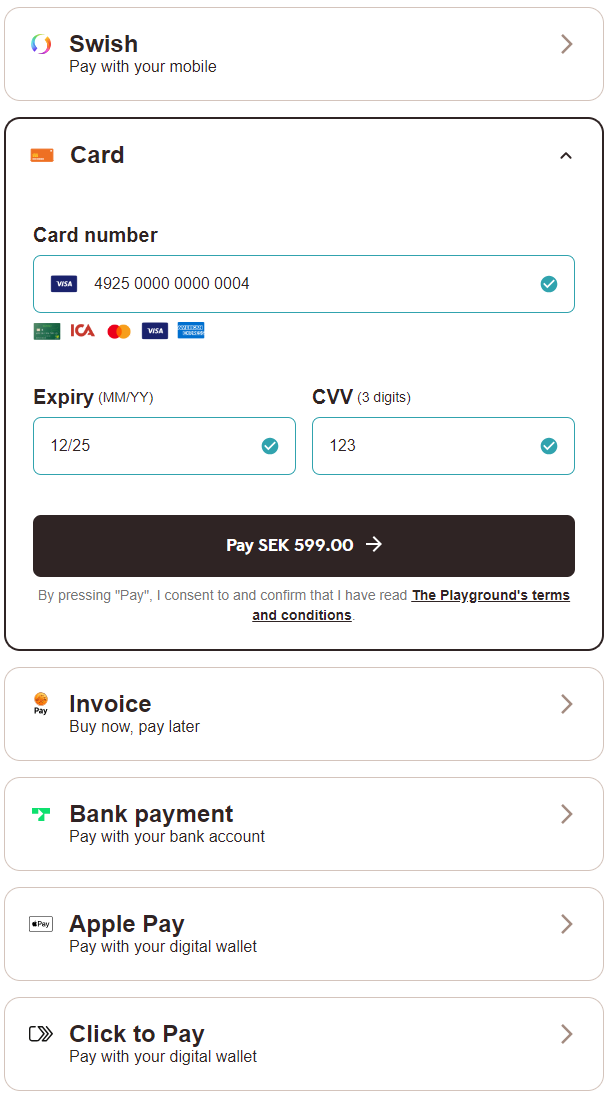

How Seamless View Looks

After opening up the client script, the menu itself will load inside of an iframe in the container you provided us earlier. From here, the payer can select their preferred payment method and pay.

Once the payer completes their purchase, you can then perform a GET towards the

paymentOrders resource to check the purchase state.

Seamless View Events

When you integrate using the Seamless View implementation, you can override one or more of our Seamless View events. This ranges from changing what happens when the payer completes or cancels their payment, to when we resize the payment menu itself. While optional, this gives you more flexibility and control over the payment flow, during and after the payer completes and/or cancels their payment attempt.

Events like onPaid allows you avoid redirecting to the completeUrl once

the payer completes or cancels the payment. This allows you to check the

payment, or just close the payment window and display a receipt on the same

page. Other events like onPaymentAttemptFailed can allow you to keep tabs on

the amount of failed attempts, for example if you want to show a warning or

a message if the payer is unable to complete a payment after several tries.

For the full list over the different events you can override, check out the Seamless View Events page, also available in the feature section.

Seamless View Sequence Diagram

Note that in this diagram, the Payer refers to the merchant front-end (website) while Merchant refers to the merchant back-end.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

participant 3rdParty

rect rgba(238, 112, 35, 0.05)

activate Payer

Payer ->>+ Merchant: Initiate Purchase

Merchant ->>+ SwedbankPay: POST /psp/paymentorders (hostUrls, paymentUrl, payer information)

SwedbankPay -->>- Merchant: rel:view-checkout

Merchant -->>- Payer: Display SwedbankPay Checkout on Merchant Page

Payer ->> Payer: Initiate Purchase step

Payer ->>+ SwedbankPay: Do purchase logic

activate SwedbankPay

opt Payer performs purchase out of iFrame

SwedbankPay ->>- Payer: Redirect to 3rd party required

Payer ->>+ 3rdParty: Redirecting to 3rd party URL

3rdParty -->>- Payer: Redirect back to paymentUrl (merchant)

Payer ->> Payer: Initiate Checkout Seamless View (open iframe)

Payer ->>+ SwedbankPay: Check purchase status

end

SwedbankPay -->>- Payer: Purchase status

deactivate SwedbankPay

alt If the purchase is completed

Payer ->>+ SwedbankPay: GET <paymentorder.id>

SwedbankPay ->>- Payer: Status: Paid/Failed

Payer ->> Payer: Show Purchase complete

Payer ->> Payer: Event: onPaid ①

note right of Payer: Unless you override OnPaid, this will<br/>cause a redirect to the CompleteUrl

else If the purchase attampt has failed

Payer ->>+ SwedbankPay: GET {paymentorder.id}

SwedbankPay -->>- Payer: Payment Status: Failed

Payer -->> Payer: Display error message in the Payment UI

Payer ->> Payer: Event: onPaymentAttemptFailed ①

end

opt PaymentOrder Callback (if callbackUrls is set) ②

SwedbankPay ->> Merchant: POST Purchase Callback

end

deactivate Payer

end

rect rgba(81,43,43,0.1)

note right of Payer: Capture

Merchant ->>+ SwedbankPay: rel:capture

SwedbankPay -->>- Merchant: Capture status

note right of Merchant: Capture here only if the purchased<br/>goods don't require shipping.<br/>If shipping is required, perform capture<br/>after the goods have shipped.<br>Should only be used for <br>payment methods that support <br>Authorizations.

end

- ① See seamless view events for further information.

- ② Read more about callback handling in the technical reference.

Change From Seamless View To Redirect UI

As parts of the PCI-DSS best practice becomes requirements with PCI-DSS v4 active from April 2025, using the Seamless View integration to display the payment UI will give merchants more responsibilities than they currently have. This is because Seamless View is hosted by you. As the Redirect integration is hosted by Swedbank Pay, we also handle these responsibilities.

The updated requirements will include stricter controls and monitoring, particularly around the security of your checkout process. Merchants are responsible for ensuring the integrity of the HTML script used in their integration, including monitoring what is loaded into or over it. Specifically, Seamless View merchants must verify that the script URL embedded in their iframe originates from Swedbank Pay or another trusted domain. It is important to note that Swedbank Pay’s PCI responsibility is strictly limited to the content within the payment iframe.

For further details, refer to section 4.6.3 and 11.6.1 in the linked PCI-DSS document.

Please note that this only applies to payment methods that are affected by PCI-DSS (Card and Click to Pay). If you only offer payment methods not affected by PCI-DSS, no actions are necessary. If you want to add PCI-DSS affected payment methods later, this is something you need to consider.

To learn more about how PCI-DSS affects you, we also have reading available in Danish, Finnish, Norwegian and Swedish.

If you currently have a Seamless View integration and don’t want the new responsibilities, switcing to Redirect is a very manageable task. Here’s what you need to do:

Use Redirect Operation

In the operations node of the payment response, right next to

view-checkout which you should currently be using, you’ll find

redirect-checkout. The corresponding href contains a url which leads to a

Swedbank Pay domain where the payment UI will be displayed and processed. All

you need to do is direct the Payer to this url and wait until one of the

functions are called (completeUrl, cancelUrl or callbackUrl) to proceed

with the payment process.

Redirect-Checkout Operation

1

2

3

4

5

6

7

8

9

10

{

"operations": [

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/payment/menu/b934d6f84a89a01852eea01190c2bbcc937ba29228ca7502df8592975ee3bb0d?_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "redirect-checkout",

"contentType": "text/html"

},

]

}

Remove Seamless View Code

You can remove all code related to the <script> element used to load the

Seamless View.

Change URLs

Finally, you need to do some changes to the urls node in your

payment request. The paymentUrl field is specific to Seamless

View and can be removed.

The url you need to add is the cancelUrl, so we know where to redirect the

payer if they chose to cancel, or you chose to abort the payment.

If you have permission to add your own logo in the payment UI and

want to add one, you also need to include a logoUrl. Follow the guidelines in

the section linked above. If no logoUrl is added, Swedbank Pay’s logo will be

shown by default.

The completeUrl, hostUrls and callbackUrl is universal and must be

included regardless of your UI choice.

Seamless View Specific URL

1

2

3

4

5

{

"urls": {

"paymentUrl": "https://example.com/perform-payment"

}

}

Redirect Specific URLs

1

2

3

4

5

6

{

"urls": {

"cancelUrl": "https://example.com/payment-cancelled",

"logoUrl": "https://example.com/logo.png" //Optional

}

}

Monitoring The Script URL

You must confirm that your site is not susceptible to attacks from scripts that could affect the merchant’s e-commerce system(s).

Seamless View - Next Steps

You are now ready to validate the payment’s status. Follow the link below to read more about how this is done.